ACCOUNTING

Our Accounting Solutions Include:

- Business, General Ledger, & Financial Statement Preparation

- Personal Financial Statements

- Bookkeeping/Write-Up – Monthly/Quarterly/Annual or as needed

- QuickBooks® Installation & Training

- Sales Tax Returns

- Business Tax Return Preparation

- Cash Flow & Budgeting Analysis

Accounting Records Create Management Information

Meaningful, well-organized financial records provide the foundation needed to run the business. Our staff can conduct your bookkeeping and accounting, manage in-house administrative support, and prepare and explain your financial statements. Many accounting systems have reporting functions that help management improve their ability to monitor activities and reduce manual efforts that may be occurring.

Frequency of Support

We will design a solution to keep accounting records as up-to-date as you need them. Some clients require less frequent support where a quarterly visit will accomplish their needs, while others need weekly contact. We can train your in-house staff to do more so you can use our time for more strategic needs rather than administrative support.

TAX

Our Tax Services Include:

- Business, Tax Planning, & Return Preparation

- Individual Tax Payer Planning & Return Preparation

- Estate Planning

- Trust Administration

- Gifting Strategies

- Divorce Support

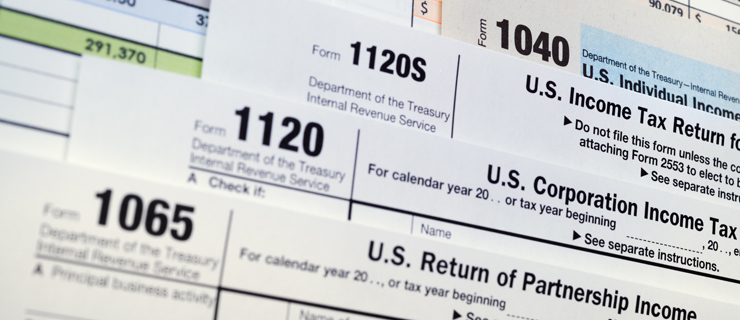

Tax Planning & Return Preparation

There are two aspects to taxes. The first is tax planning, which is often an overlooked and underserviced area. Taxes do not have to be a surprise event. Planning helps clients reduce or defer tax liability, take advantage of temporary tax credits or deductions, and help forecast the cash flow needed to pay taxes that are due. The second aspect is return preparation. If the accounting records are in order and some planning has occurred, then the tax return preparation becomes a less complex task.

The Need for Frequent Updates

We become our individual and business clients tax advisors. However, tax regulations as well as your business and/or personal financial situation may change, which requires interim communication and sometimes action to change an existing approach to your tax plans and overall financial well-being.

- Sales Tax Reporting

- Multi-state Tax Needs

- IRS Representation

- Tax Analysis or Buying or Selling a Business

- Exit and Succession Tax Planning